Posted on

April 4, 2023

by

JEFF QIAN

Home prices across Metro Vancouver’s housing market showed modest increases in March, while new listings remained below long-term historical averages.

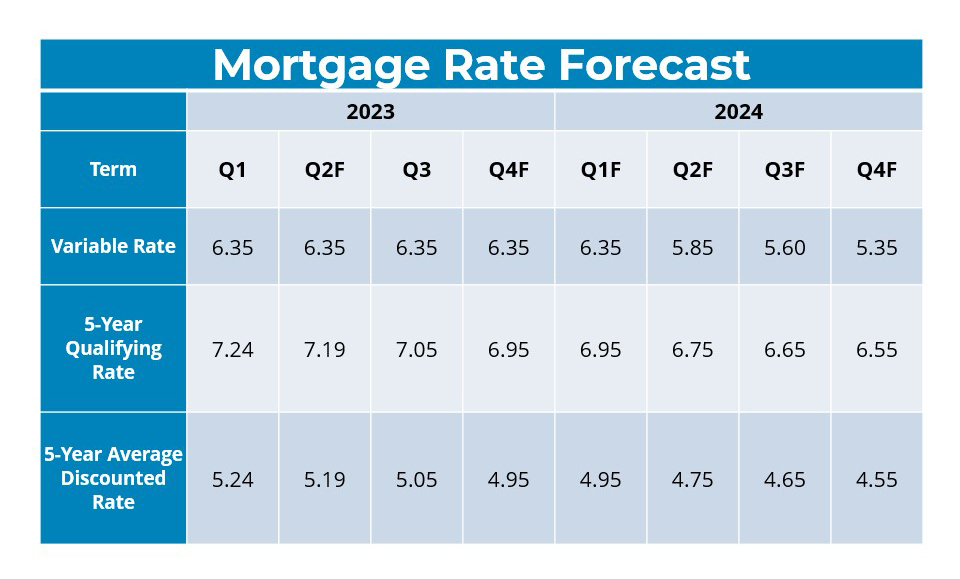

March data also indicates home sales are making a stronger than expected spring showing so far, despite elevated borrowing costs.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,535 in March 2023, a 42.5 per cent decrease from the 4,405 sales recorded in March 2022, and 28.4 per cent below the 10-year seasonal average (3,540).

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,143,900. This represents a 9.5 per cent decrease over March 2022 and a 1.8 per cent increase compared to February 2023.

“On the pricing side, the spring market is already on track to outpace our 2023 forecast, which anticipated modest price increases of about one to two per cent across all product types,” Andrew Lis, REBGV’s director of economics and data analytics said. “The surprising part of this recent activity is that these price increases are occurring against a backdrop of elevated borrowing costs, below-average sales, and new listing activity that continues to suggest that sellers are awaiting more favorable market conditions.”

There were 4,317 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in March 2023. This represents a 35.5 per cent decrease compared to the 6,690 homes listed in March 2022, and was 22.3 per cent below the 10-year seasonal average (5,553).

The total number of homes currently listed for sale on the MLS® system in Metro Vancouver is 8,617, an 8.1 per cent increase compared to March 2022 (7,970), and 17.3 per cent below the 10-year seasonal average (10,421).

Across all detached, attached and apartment property types, the sales-to-active listings ratio for March 2023 is 30.7 per cent. By property type, the ratio is 23.3 per cent for detached homes, 36.7 per cent for townhomes, and 34.9 per cent for apartments.

Analysis of historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“If home sellers remain on the sidelines, monthly MLS® sales figures will continue to appear lower than historical averages as we move toward summer,” Lis said. “But it’s important to recognize the chicken-and-egg nature of these statistics. The number of sales in any given month is partially determined by the number of homes that come to market that month, along with the inventory of unsold homes listed in previous months. With fewer homes coming on the market, homes sales will remain lower than we’re accustomed to seeing at this point in the year, almost entirely by definition.”

Sales of detached homes in March 2023 reached 734, a 43.6 per cent decrease from the 1,302 detached sales recorded in March 2022. The benchmark price for detached properties is $1,861,800. This represents an 11.2 per cent decrease from March 2022 and a 2.7 per cent increase compared to February 2023.

Sales of apartment homes reached 1,311 in March 2023, a 43.2 per cent decrease compared to the 2,310 sales in March 2022. The benchmark price of an apartment property is $737,400. This represents a 4.6 per cent decrease from March 2022 and a 0.7 per cent increase compared to February 2023.

Attached home sales in March 2023 totalled 466, a 37.3 per cent decrease compared to the 743 sales in March 2022. The benchmark price of an attached unit is $1,056,400. This represents a 7.8 per cent decrease from March 2022 and a 1.7 per cent increase compared to February 2023.