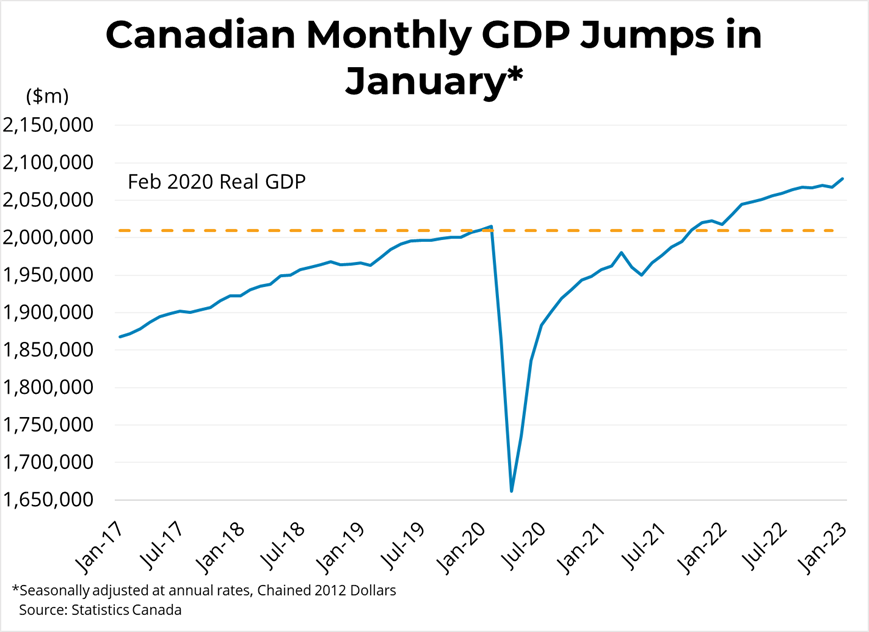

The large jump in GDP in January bucked expectations of continued slowing as tighter monetary policy worked its way through the Canadian economy. Growth was softer than expected in the fourth quarter of 2022, supporting the Bank of Canada's 'conditional pause' on further rate hikes. In contrast, this month's strong number would normally bias the Bank of Canada toward additional monetary tightening, but progress on bringing down inflation, alongside the lingering uncertainty stemming from bank failures in the United States, will likely keep the Bank on hold. With employment markets remaining tight but inflation appearing to soften, the Bank will be weighing the evidence before its next rate announcement on April 12th.